Your credit score is one of the most important factors lenders consider when deciding whether to approve a loan. Whether you’re applying for a personal loan, a mortgage, a car loan, or even a credit card, your creditworthiness plays a significant role in the interest rates you receive and the terms of your loan.

Knowing your credit score before applying for a loan gives you a clear understanding of your financial position. It can help you make informed decisions, avoid unnecessary rejections, and even improve your chances of securing a better interest rate. In this guide, we’ll explain how to check my credit score before applying for a loan, why it matters, and what steps you can take to improve it.

What is a Credit Score?

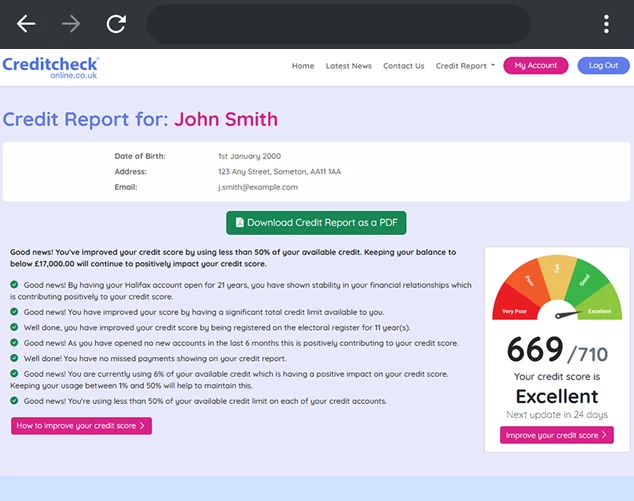

A credit score is a three-digit number that represents your creditworthiness based on your financial history. In the UK, three main credit reference agencies (CRAs) generate credit scores:

-

Experian – Scores range from 0 to 999

-

Equifax – Scores range from 0 to 700

-

TransUnion – Scores range from 0 to 710

Your score is calculated based on factors such as:

-

Payment history – Whether you pay your bills and debts on time.

-

Credit utilization – How much of your available credit you are using.

-

Length of credit history – How long you’ve had active credit accounts.

-

Credit mix – Types of credit accounts, such as loans, credit cards, or mortgages.

-

Recent credit applications – How often you apply for new credit.

A higher score indicates better creditworthiness, which increases your chances of loan approval and favorable terms. Conversely, a lower score may result in higher interest rates or even rejection.

Why Checking Your Credit Score Before a Loan is Important

Many people apply for loans without knowing their credit score, only to face rejection or high-interest rates. Checking your score beforehand offers several benefits:

-

Know Your Chances of Approval – By understanding your credit score, you can apply for loans that match your financial profile.

-

Avoid Hard Inquiries – Each loan application triggers a hard inquiry, which can slightly reduce your score. Checking your score in advance helps you apply strategically.

-

Spot Errors Early – Credit reports may contain mistakes, such as incorrect balances or accounts, which can negatively impact your score.

-

Plan to Improve Your Score – If your score is low, you have time to make improvements before applying, increasing your approval chances.

-

Save Money – A better credit score often qualifies you for lower interest rates, saving you hundreds or even thousands of pounds over the life of a loan.

How to Check Your Credit Score Online Before Applying for a Loan

There are several simple and free ways to check your credit score online in the UK:

1. Credit Reference Agencies (CRAs)

You can check your score directly through the major credit bureaus:

-

Experian – Offers free access to your credit score and report. Signing up allows you to monitor changes and receive tips to improve your rating.

-

Equifax – Provides free access through platforms like ClearScore, which updates your score weekly and gives insights on how to boost it.

-

TransUnion – Powers services like Credit Karma, offering detailed reports, alerts, and guidance to improve your credit score.

These platforms provide soft searches, meaning checking your own score won’t negatively impact it.

2. Banking and Credit Card Apps

Many banks in the UK, such as Barclays, Monzo, and NatWest, provide free credit score access through their online banking apps. This is a secure and convenient way to see your score instantly.

3. Third-Party Websites

Websites like ClearScore, Credit Karma, and NerdWallet offer free, instant access to your credit score and detailed reports. They also provide tailored recommendations for improving your score.

4. Government-Approved Services

By law, you’re entitled to a free annual credit report from each CRA. While this report may not always include your score, it shows detailed account information and is essential for spotting errors.

How Often Should You Check Your Credit Score?

You don’t need to check your score daily. For most people, checking once a month is sufficient, especially if you’re preparing to apply for a loan. Key times to check include:

-

Before applying for any loan, mortgage, or credit card

-

After paying off large debts or loans

-

After making major financial decisions, like opening new accounts

Soft searches from these checks do not affect your credit rating, so you can monitor your score as often as needed.

Tips to Improve Your Credit Score Before a Loan

If your score isn’t as high as you’d like, there are several steps you can take to improve it before applying for a loan:

-

✅ Pay bills on time – Late payments negatively impact your score.

-

✅ Reduce credit card balances – Aim to use less than 30% of your available credit.

-

✅ Avoid multiple loan applications – Too many hard inquiries can lower your score.

-

✅ Correct errors on your report – Dispute mistakes promptly.

-

✅ Maintain older accounts – Longer credit history is favorable.

-

✅ Register on the electoral roll – Enhances credibility with lenders.

Taking these steps even a few months before applying can significantly improve your chances of approval and better loan terms.

Understanding Your Credit Score

Knowing what your credit score means is important:

-

Excellent – Likely to be approved with the best rates.

-

Good – High chance of approval, though rates may be slightly higher.

-

Fair – May face higher interest rates and stricter terms.

-

Poor – Higher likelihood of rejection or expensive borrowing terms.

Understanding your score allows you to target loans that match your credit profile, improving your chances of success.

Final Thoughts

Checking your credit score before applying for a loan is a smart financial habit. It allows you to monitor your credit health, spot errors, and take steps to improve your rating. Using online tools, banking apps, and free services from credit bureaus, you can access your score in minutes—without negatively affecting your credit.

By staying informed and responsible with your finances, you increase your chances of securing a loan with favorable terms and lower interest rates. Start by checking your credit score today, and take control of your financial future. FOR MORE INFO HERE https://creditcheckonline.co.uk/