Gold has long been considered a symbol of wealth, a protected-haven asset, and a hedge towards inflation. In the United States, the marketplace for gold has advanced over the years, shaped by financial fluctuations, investor sentiment, and technological developments. This case study explores the dynamics of gold for sale within the U.S. market, analyzing its historical context, present developments, and future outlook.

Historic Context

Gold has been valued for 1000’s of years, with its use relationship again to historical civilizations. Within the U.S., gold gained prominence throughout the California Gold Rush of the mid-nineteenth century, which spurred economic progress and westward enlargement. The establishment of the Gold Customary in the late 19th century additional solidified gold’s position in the American economy, because it grew to become the idea for foreign money valuation.

However, the Gold Standard was abandoned during the good Depression in 1933, resulting in a period of fluctuating gold costs. It wasn’t until the 1970s that the U.S. fully transitioned to a fiat currency system, permitting gold prices to float freely. This shift marked the beginning of a new period for gold, remodeling it into a speculative asset and a store of worth.

Current Developments in Gold Gross sales

In recent times, the demand for gold within the U.S. has seen vital modifications due to various elements. The COVID-19 pandemic, for instance, prompted a surge in gold purchases as traders sought secure-haven property amidst financial uncertainty. In keeping with the World Gold Council, U.S. gold demand reached a document excessive in 2020, with a notable increase in retail investment and gold-backed exchange-traded funds (ETFs).

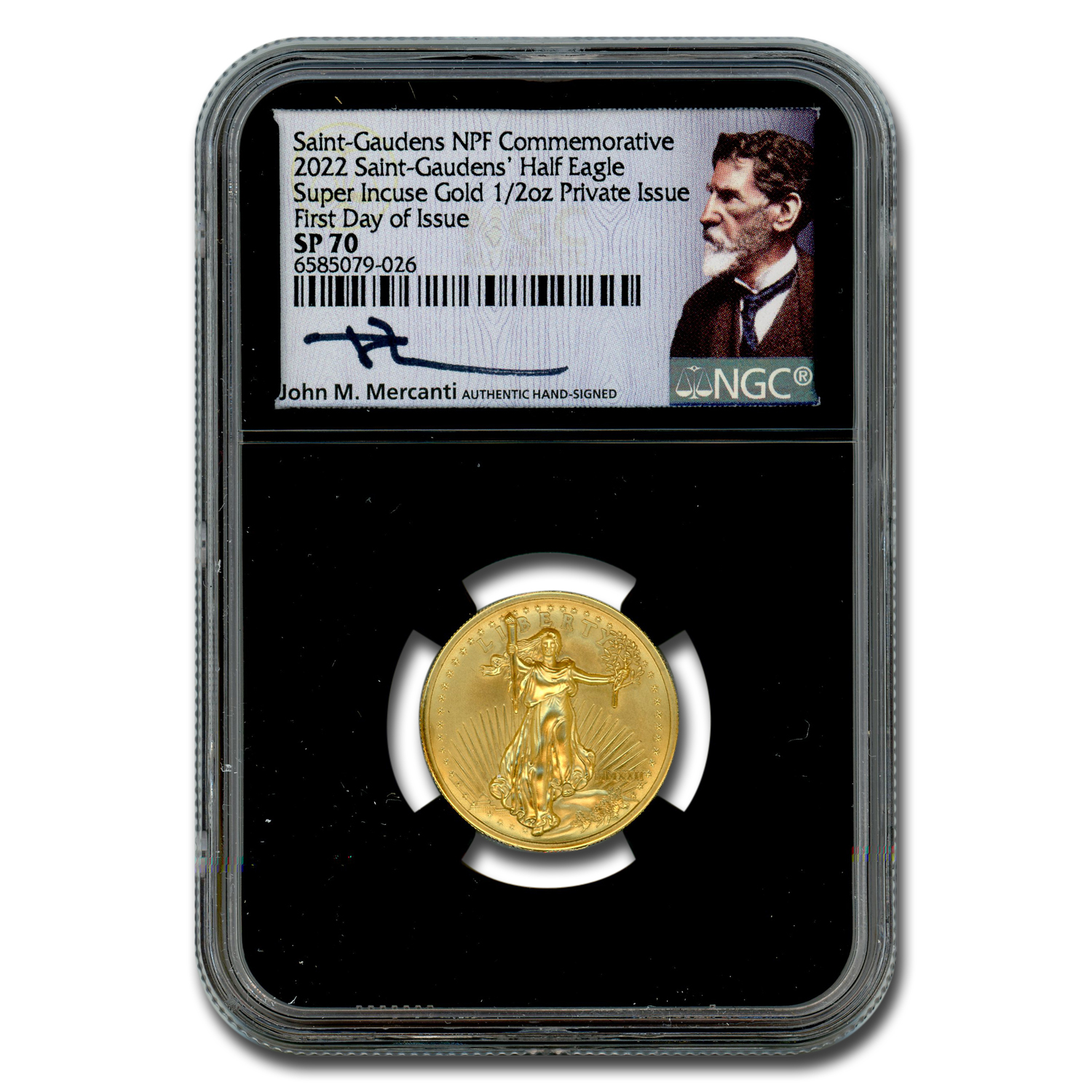

The rise of digital expertise has also remodeled the landscape of gold gross sales. On-line platforms and cellular purposes now allow consumers to purchase and promote gold with ease, offering better accessibility and convenience. Firms like APMEX and JM Bullion have capitalized on this development, providing a variety of merchandise, together with coins, bars, and bullion.

Components Influencing Gold Costs

A number of key factors affect the worth of gold in the U.S. market:

- Financial Indicators: Gold prices are closely tied to economic indicators corresponding to inflation rates, interest rates, and foreign money power. When inflation rises or the U.S. dollar weakens, traders usually flock to gold as a hedge, driving prices up.

- Geopolitical Tensions: Uncertainty in global politics can result in elevated demand for gold. Events equivalent to commerce wars, navy conflicts, and political instability typically prompt buyers to seek refuge in gold, which is perceived as a stable asset.

- Central Financial institution Insurance policies: The actions of central banks, particularly the Federal Reserve, play a significant function in gold costs. Low-curiosity rates and quantitative easing can lead to larger gold prices, as these policies diminish the chance cost of holding non-yielding assets like gold.

- Market Sentiment: Investor sentiment and market psychology also impact gold prices. Bullish sentiment can drive prices larger, while bearish sentiment can result in declines. The sentiment is often reflected in the volume of gold purchases and sales.

Challenges within the Gold Market

Regardless of its allure, the gold market faces several challenges. Considered one of the primary considerations is the environmental influence of gold mining. The extraction process can result in deforestation, water pollution, and habitat destruction. As consciousness of environmental points grows, shoppers are increasingly seeking ethically sourced gold, prompting companies to adopt more sustainable practices.

Additionally, regulatory challenges can affect gold sales. The U. If you loved this short article and you would like to acquire extra facts concerning Vgrouprealestate.Com.au kindly visit the web page. S. government imposes taxes on the sale of gold, which can deter some buyers. Moreover, the potential for fraud in the gold market stays a priority, as counterfeit products can undermine shopper confidence.

Future Outlook

Wanting ahead, the way forward for gold for sale within the U.S. market seems promising, albeit with uncertainties. Analysts predict that gold will continue to be a popular funding alternative, buy gold bars significantly in instances of financial instability. As inflation issues persist and geopolitical tensions remain, gold’s status as a secure-haven asset is more likely to endure.

The rise of digital gold platforms and innovations in gold-backed cryptocurrencies can also shape the future of gold sales. These developments may entice a younger demographic of investors who are extra snug with digital transactions and alternative funding vehicles.

Furthermore, the push for sustainable and ethical sourcing of gold is predicted to achieve momentum. Corporations that prioritize responsible mining practices and transparency in their supply chains could discover a competitive edge out there.

Conclusion

The dynamics of gold for sale in the U.S. market are influenced by a fancy interplay of historical context, financial elements, and consumer behavior. As gold continues to be considered as a invaluable asset, understanding these dynamics is crucial for traders, policymakers, and industry stakeholders. With ongoing changes in technology, market sentiment, and environmental concerns, the gold market is poised for continued evolution within the years to come back. Investors must stay vigilant and knowledgeable to navigate this ever-altering panorama successfully.