In recent times, the funding landscape has witnessed a big shift as more people search various property to safeguard their wealth. Amongst these alternatives, gold has emerged as a popular alternative, significantly by means of Individual Retirement Accounts (IRAs) that allow for gold investments. This case examine explores the idea of IRA gold accounts, their benefits, challenges, and the components contributing to their rising popularity.

Understanding IRA Gold Accounts

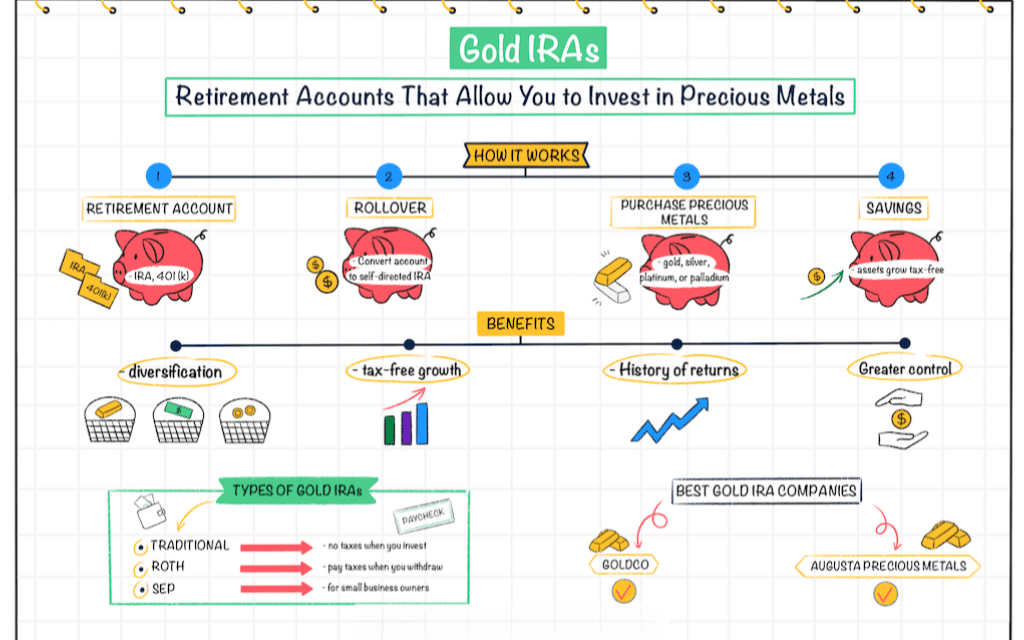

An IRA gold account is a specialised kind of self-directed Individual Retirement Account that allows investors to hold bodily gold and different treasured metals as a part of their retirement portfolio. Not like traditional IRAs, which sometimes include stocks, bonds, and mutual funds, IRA gold accounts present a singular alternative to invest in tangible assets. This diversification can potentially protect traders in opposition to market volatility and inflation.

The benefits of IRA Gold Accounts

- Inflation Hedge: One among the primary reasons investors flip to gold is its historical role as a hedge against inflation. When the buying power of fiat currencies declines, recommended gold ira firms for 2024 usually retains its value, making it an attractive option for lengthy-time period investors.

- Portfolio Diversification: Incorporating gold into an investment portfolio can enhance diversification. Gold often behaves otherwise than stocks and bonds, which signifies that throughout durations of financial uncertainty, gold can provide stability and scale back general portfolio risk.

- Tax Advantages: Like traditional IRAs, IRA gold accounts provide tax-deferred growth. Because of this buyers do not pay taxes on the beneficial properties from their gold investments till they withdraw funds during retirement, potentially resulting in vital tax savings.

- Security and Tangibility: Physical gold is a tangible asset that individuals can hold, which offers a way of safety. In instances of monetary crisis or geopolitical instability, having a portion of wealth in physical kind can be reassuring.

Setting up an IRA Gold Account

Establishing an IRA gold account includes a number of steps. First, buyers want to pick a custodian who makes a speciality of self-directed IRAs and is authorized to handle precious metals. The custodian will manage the account and guarantee compliance with IRS rules.

Next, investors should fund their IRA gold account, either through a direct contribution or by rolling over funds from an present retirement account. Once the account is funded, buyers can buy permitted gold merchandise, reminiscent of American Gold Eagles, Canadian Gold Maple Leafs, or gold bars, which should meet specific purity requirements set by the IRS.

Regulatory Issues

Investing in an IRA gold account comes with regulatory requirements that must be adhered to so as to take care of the tax-advantaged status of the account. The IRS mandates that the gold should be stored in an permitted depository, and individuals can’t take physical possession of the gold whereas it stays within the IRA. This requirement ensures that the investment remains compliant with tax laws.

Challenges and Dangers

While IRA gold accounts provide numerous benefits, they don’t seem to be with out challenges and dangers. A few of the important thing issues include:

- Market Volatility: Although gold is often seen as a protected haven, its value will be unstable. Traders have to be prepared for fluctuations in the value of their gold holdings, which might affect their total retirement strategy.

- Storage and Insurance coverage Prices: Storing physical gold in a safe depository incurs prices, including storage charges and insurance. These bills can reduce the general returns on the funding.

- Restricted Funding Options: In contrast to conventional IRAs that supply a wide range of investment choices, IRA gold accounts are limited to particular varieties of precious metals. This restriction could not align with each investor’s strategy.

- Potential for Scams: The rising reputation of IRA gold accounts has sadly led to a rise in scams and unscrupulous sellers. Buyers should conduct thorough due diligence when choosing a custodian and purchasing gold to avoid fraudulent schemes.

The Rising Popularity of IRA Gold Accounts

The rise of IRA gold accounts can be attributed to a number of elements. Financial uncertainty, geopolitical tensions, and a growing consciousness of the benefits of diversification have prompted many investors to contemplate gold as a viable option for his or her retirement portfolios. Furthermore, the benefit of organising a self-directed IRA and the potential for tax advantages have made these accounts more and more engaging.

The COVID-19 pandemic additionally performed a big position in driving curiosity in gold investments. As governments around the world carried out stimulus measures and monetary policies that raised concerns about inflation and forex devaluation, many buyers turned to gold as a secure gold-backed ira investment haven asset. This pattern has continued as financial recovery remains uncertain in some regions.

Case Examples

For instance the effectiveness of IRA gold accounts, consider the following case examples:

- Case Examine: The Conservative Investor

John, a 55-yr-previous conservative investor, was involved concerning the potential influence of inflation on his retirement savings. After consulting with a financial advisor, he decided to allocate 15% of his IRA into a gold account. Over the next five years, as inflation rose, John’s gold investments appreciated significantly, helping to offset losses in his stock portfolio. When he reached retirement age, the gold provided him with a strong monetary basis.

- Case Research: The Younger Skilled

Emily, a 30-12 months-outdated skilled, recognized the significance of starting her retirement planning early. She opened a self-directed IRA and invested a portion of her contributions in gold. As an extended-time period investment technique, Emily’s gold holdings not only grew in worth but also supplied her with peace of mind, figuring out she had a hedge towards financial uncertainty.

Conclusion

IRA gold accounts symbolize a compelling investment alternative for individuals looking to diversify their retirement portfolios and protect their wealth from financial volatility. If you liked this article so you would like to receive more info pertaining to Easyern.Site please visit our own webpage. Whereas they include their own set of challenges and dangers, the potential benefits—such as inflation hedging, tax advantages, and portfolio diversification—make them a gorgeous choice for a lot of investors. As the financial panorama continues to evolve, the role of gold in retirement planning is likely to stay important, offering a tangible asset that may present safety and stability in uncertain instances. As at all times, buyers should conduct thorough research and seek the advice of with monetary professionals before making any funding selections to make sure that their methods align with their long-term targets.